Kelly Criterion Betting Strategy: Optimize Your Bankroll Management

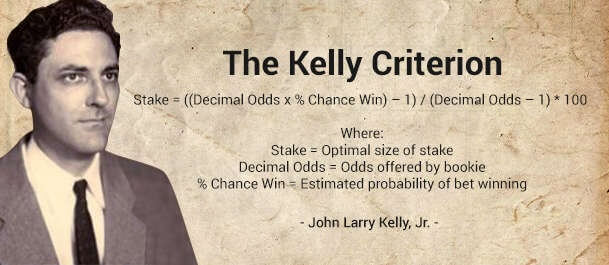

The Kelly Criterion 📊 is one of the most popular money management systems in sports betting and investing. Developed by John L. Kelly in 1956, this formula helps bettors determine the optimal stake to maximize long-term growth while minimizing the risk of losing their bankroll.

📌 What Is the Kelly Criterion?

The Kelly Criterion is a mathematical formula designed to calculate the optimal percentage of your bankroll to wager on a given bet. Unlike flat betting or Martingale strategies, the Kelly approach adapts to both the size of your bankroll and the perceived edge you hold over the bookmaker.

🧮 The Kelly Formula

The general formula for the Kelly Criterion is:

f* = (bp - q) / b

- f* = fraction of your bankroll to wager

- b = decimal odds minus 1

- p = probability of winning (your estimate)

- q = 1 – p (probability of losing)

Example:

If a football team has odds of 2.50 (b = 1.5), and you believe their true chance of winning is 45% (p = 0.45):

f* = (1.5 × 0.45 - 0.55) / 1.5 = (0.675 - 0.55) / 1.5 = 0.083 or 8.3%

You should bet 8.3% of your bankroll on this match.

✅ Advantages of the Kelly Criterion

- 📈 Maximizes long-term bankroll growth.

- 🛡️ Reduces risk of complete ruin compared to flat staking.

- ⚖️ Adjusts stake size based on your perceived edge.

- 📊 Encourages disciplined bankroll management.

⚠️ Limitations of the Kelly Criterion

- 🔮 Requires accurate probability estimation — if your edge is wrong, results may be negative.

- 💰 Can suggest large bet sizes in high-value situations, which may feel risky.

- 🔄 Variance can still cause big swings in bankroll size.

🔧 Practical Tips for Using Kelly Criterion

- 👉 Many bettors use a half-Kelly (50% of the suggested stake) to reduce variance.

- 👉 Track your bets and your probability assessments for accuracy over time.

- 👉 Avoid applying Kelly to markets where you have little to no edge.

- 👉 Use Kelly Criterion calculators online to speed up stake size decisions.

🛠 Kelly Criterion Calculator

Try this simple calculator to estimate your optimal stake: Decimal Odds: Estimated Probability (%): Bankroll (€): 🔍 Calculate Stake

🎯 Conclusion

The Kelly Criterion is a powerful bankroll management tool that helps maximize growth and minimize risk. While it requires accurate probability estimates, using it — even in a fractional form — can significantly improve your betting discipline and profitability over time.