Kelly Criterion

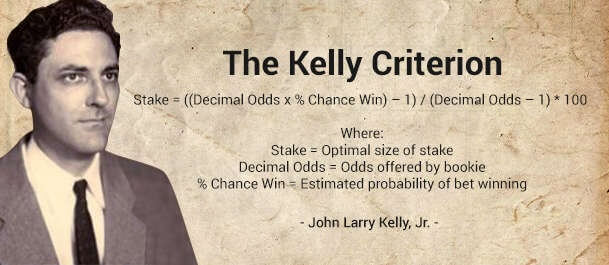

Kelly Criterions is based on a theory enunciated in 1956 by the American mathematician John Larry Kelly Jr., who then gave the method its name, in the Bell System Technical Journal. The usefulness of this system is due to its ability to determine the amount to invest in a bet starting from the entire budget available to the bettor.

Here are the four parameters to set in the Kelly Criterion for betting:

- The bankroll available to invest

- A match we want to bet on

- The probability that a prediction will come true (percentage success)

- The odds of the bet we want to bet

Starting from the four variables that you see above, the Kelly criterion will indicate the exact amount that we must invest to minimize risks and minimize any losses.

Kelly’s Mathematical formula

The mathematical formula is as follows: ((Q x P) – 1) / (Q – 1), where Q stands for the odds of the bet we want to bet and P for the probability that the prediction will come true.

How does the Kelly criterion for betting work?

We realize that from just explaining the parameters to use and the mathematical formula it is difficult to understand how Kelly works. So let’s see step by step all the steps to follow to successfully use this system. In this article we have summarized and explained the six main steps of the Kelly system:

- Establish an initial budget

Based on your financial resources and the amount you want to invest, decide the amount of your bankroll to use in Kelly. Remember that if you want to apply the fractional version of the method you will need to divide your initial budget in half and plug that number into the formula. - Choose a game to bet

Consult the schedule of the bookmaker chosen from those proposed on this page and find a match that is right for you. It’s important that you choose an event of a sport and a championship that you know well. - Select a tip

Choose a market and an outcome for your bet. In this step, your betting skills are very important for the success of the system. - Evaluate the probability of the outcome

With your knowledge of the chosen sport and after having carefully consulted the statistics, establish the probability in percentage terms of the outcome you have chosen. - Calculate the stake for this game

Enter the bankroll data, the odds of the chosen bet and the probability of the prediction in the formula and calculate the stake to bet, thus determining the amount to bet. - Repeat the operation on the next bet

Once the bet event is finished, remember to update your bankroll with the amount won or lost and repeat the operation with the next bet.

Kelly Criterion example with a soccer game

An example of using Kelly’s criterion for soccer bets allows you to understand even better how this method is used. Assume a match to be played between Barcelona and Real Madrid with a hypothesis equal to 30% probability of winning the second team.

The bookmaker you rely on quotes a Real Madrid win at 2.5. Your budget is available. €200. Recalling that Kelly’s formula is [(qxp-1)/(q-1)]=f, then: [(2.5×30/100)]-[1/(2.5-1)]x100=8, 33. Thus, the percentage of the bankroll that you have to invest in winning Real Madrid is 8.33% of the budget you have available (€200), which is equivalent to €16.50.

- Match Barcelona and Real Madrid, with probability equal to 30%.

- Real Madrid have odds of 2.50.

- You have a budget of €200.

- You use the formula we gave you: [(2.5×30/100)]-[1/(2.5-1)]x100=8.33

- You have to invest 8.33% of your €200 budget, which is €16.50.

As you can see, the Kelly criterion allows you to better manage your budget, maximize the growth of your money, and prevent it from ending abruptly following hasty, unreasonable and/or incorrect bets. In the long run, it’s always best to use these types of strategies.

Pros and cons of the Kelly criterion

Given the previous example we can easily understand why the most expert gamblers use this betting system and we can also realize how complicated it is to use it. Like any gaming system, in fact, this too has its advantages and disadvantages.

An advantage of Kelly’s criterion is that it certainly establishes the amount to be bet to play on a given odds. Despite the difficulties that can be encountered at the beginning in using the formula, it later becomes much more mechanical and immediate. Kelly’s criterion also measures your bankroll and that’s definitely a good thing. Always with a view to maximizing profits with a minimum bet, the percentage or decimal value of the amount to bet would prove to be the effectively optimal one to win more while losing significantly much less.

There are, however, some disadvantages to using the Kelly criterion, two in particular. The first is something we’ve already referred to: it’s only really useful when you’re able to accurately calculate the odds of any proposed bet. If you can’t do it reasonably well, then the whole system falls like a house of cards. Wrong amounts will only make you lose your bankroll.

The second of these disadvantages is that the Kelly criterion could be considered too “aggressive”. In fact, betting 10% of your bankroll is a very high sum and, in fact, many expert players prefer to play no more than 5%, some even go down to 2%. Precisely, however, this aggressiveness can be fought by assuming a more cautious relationship with the results.

Who is the Kelly Criterion suitable for?

Even if there are enthusiastic comments on the Kelly Criterion applied to betting on the net, it is not said that it is always the right method to use. We recommend the use of this system only to very experienced players, who are familiar with both the logic of betting and the dynamics of the sport they want to bet on: the ability to develop intuition for value is acquired only over time.

The biggest obstacle is not in itself the complicated mathematical formula, which can be tackled with the tools we have indicated above. The experience of a bettor is an essential fact here and is necessary in assessing the probability that an outcome will come true. Only by managing to establish this percentage as precisely as possible will the method give the best results. This system could also be useful for those who play betting exchanges, as it can help determine whether it is more convenient to bet or lay on a given event.

Have you tried this method but it’s not for you? Try the Masaniello method. Go to the dedicated article->